Q1 2025 Ammo Price Trends Report

Author: Aleksa M. | Publish Date: Apr 02, 2025 | Fact checked by: Marko Lalovic

Market Overview

The first quarter of 2025 was marked by relative price stability in the ammunition market. Throughout January, February, and March, the Ammo Price Index remained within a narrow range, suggesting stable consumer demand and consistent supply. However, a temporary spike in mid-February and significant movement in niche calibers during March indicate some underlying volatility.

While the broader market remained calm, a few factors—including inflation, seasonal shifts, and online interest—continue to influence localized price swings. Notably, several uncommon calibers saw sharp price fluctuations, driven more by supply-side factors than by widespread consumer behavior.

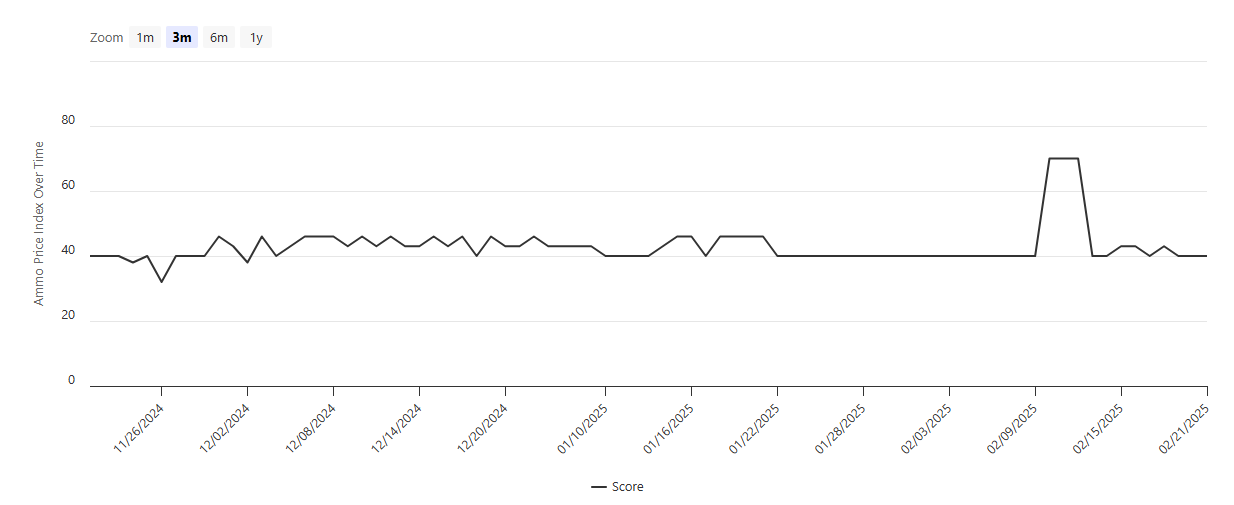

Ammo Price Index Movement

Source: Ammo Price Tracker by Black Basin Outdoors

As of the end of March 2025, the Ammo Price Index sits at 38.00, unchanged from the start of the quarter. Despite a short-lived surge above 60 in mid-February, prices quickly returned to baseline levels, indicating the spike was likely due to temporary scarcity, possible tracking error or short-term consumer behavior rather than systemic market change.

Overall, the index has remained between 37 and 43 throughout Q1, reflecting a steady and predictable ammo market environment.

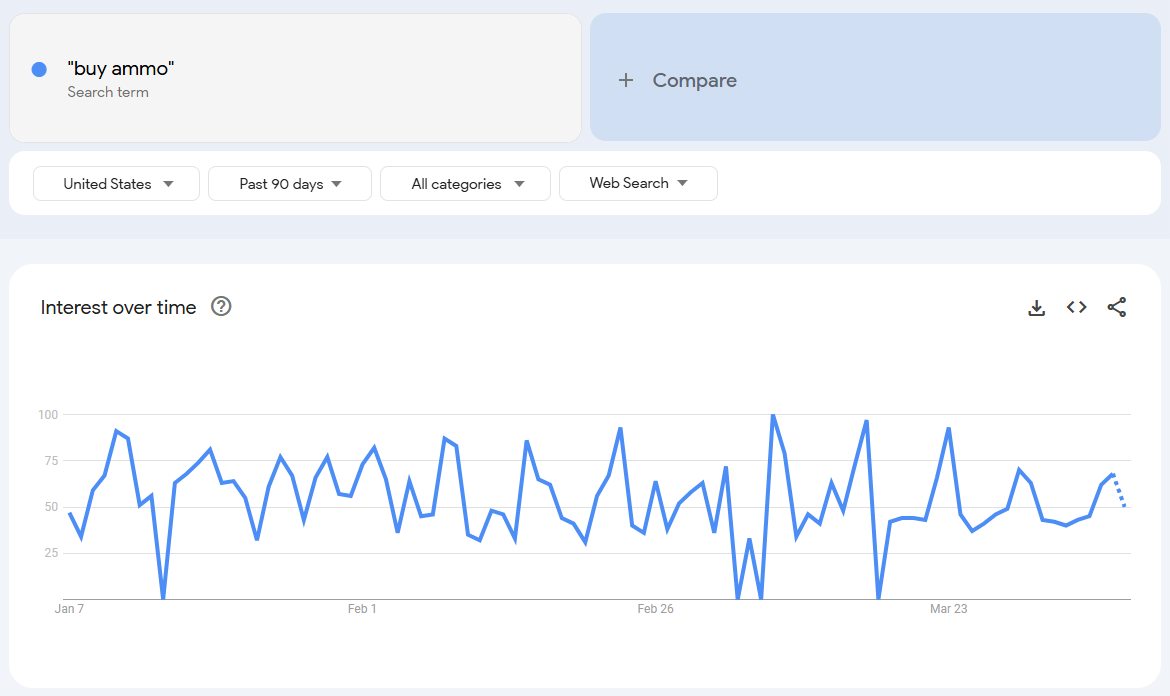

Google Trends Interest: Consistent Throughout Q1

Online interest in the term "buy ammo" has been consistent throughout Q1, with Google Trends scores ranging from 45 to 95. These weekly peaks suggest regular buyer activity and point to sustained public interest, even in the absence of major market disruptions.

Why this matters: Online search behavior often predicts buying activity. This ongoing interest could signal a stable retail market going into Q2, especially if consumer confidence holds and supply chains remain smooth.

Biggest Caliber Price Movements (March 2025)

While the overall market remained stable in Q1, individual caliber prices in March saw notable movements:

| Caliber | Price per Round | 1-Month Trend | Commentary |

|---|---|---|---|

| 10mm Magnum (Handgun) | $1.15 | +77.61% | Renewed interest in personal defense and limited inventory pushed prices sharply upward. |

| 22 TCM (Handgun/Rifle) | $0.40 | +40.24% | Spikes in enthusiast-driven purchases and rarity fueled this gain. |

| 6.5 SAUM 4S (Rifle) | $1.34 | +32.87% | High demand from precision shooters and low production drove up prices. |

| .378 Weatherby Magnum (Rifle) | $7.43 | +17.02% | Big-game hunting interest and scarcity caused a moderate surge. |

| 380 ACP (Handgun) | $0.28 | +15.11% | Popular for concealed carry; modest price increase due to bulk buys. |

| 300 HAM'R (Rifle) | $0.58 | -44.49% | Oversupply and reduced interest led to a steep decline. |

| 8mm Lebel (Rifle) | $0.71 | -39.89% | Niche collectible round lost momentum after early-year bump. |

| 223 Remington (Rifle) | $0.27 | -32.22% | Large inventories and retail promotions pushed prices down. |

| .38-55 Winchester (Rifle) | $1.74 | -28.05% | Demand softened post-hunting season. |

| 45 GAP (Handgun) | $0.40 | -17.10% | Caliber's decline in law enforcement and civilian use continues. |

Looking Forward

Several key industry developments could shape ammo prices in Q2 and beyond:

-

ATF Import Rule Changes (Pending)

New restrictions on imported ammunition components are under review and may go into effect later in 2025. If enacted, prices for calibers reliant on foreign brass or primers could rise significantly due to sourcing issues. -

Priming Compound Shortages

A Q1 report from several U.S. manufacturers revealed continued difficulty acquiring priming chemicals. If this persists, production delays and price hikes may follow, especially for small rifle primers. -

Eastern Europe Instability

Ongoing regional tensions in Eastern Europe have the potential to tighten global supply chains. While not currently affecting the U.S. civilian market, a sudden escalation could impact international ammo sources—particularly surplus military imports. -

Domestic Manufacturing Expansion

Some U.S.-based manufacturers are ramping up capacity, with new plants expected to come online mid-2025. This could help stabilize prices long-term, especially for high-demand calibers like 9mm and 5.56 NATO. - UPDATE (April 7th 2025): The recent tariff increases imposed by the U.S. government under President Donald Trump are poised to significantly impact ammunition prices in the United States. These tariffs, targeting a broad range of imports, have introduced new economic dynamics that are particularly influential in the ammunition market, which relies heavily on foreign manufacturers.

Read More: How the Recent U.S. Tariff Increase is Affecting Ammo Prices

Conclusion

The first quarter of 2025 offered a calm but complex picture of the ammo market. While the Ammo Price Index remained steady and general interest held firm, specific calibers showed sharp volatility due to supply, demand, and niche market behavior.

The most significant changes were concentrated in March, where price spikes in 10mm Magnum and 22 TCM contrasted steep drops in 223 Remington and 300 HAM’R. These outliers demonstrate how quickly prices can shift when availability or interest changes.

Looking ahead, potential regulatory updates and supply chain vulnerabilities could influence Q2 trends. Keep an eye on legislative developments, raw material availability, and global tensions.

Check back next month for a fresh update and deeper dive into new market dynamics.

Author:

Aleksa Miladinovic

Aleksa Miladinovic is a passionate technology enthusiast born and raised in Serbia, whose interest in defense technology was sparked by his country's rich firearms manufacturing heritage. His journey began when attending a Partner defense exhibition in Belgrade, where he was captivated by the innovative engineering and precision mechanics behind modern defense systems. With Serbia being a significant producer of military equipment in the region, Aleksa has developed a deep appreciation for the technical advancements and engineering excellence that the firearms industry represents.