November 2024: Ammo Prices Trends

Author: Nick Miles | Publish Date: Dec 01, 2024

Quick Overview

Ammo prices surged into the election on fears over what a Harris victory would mean for the 2A industry

After Trump won, ammo prices faded due to renewed confidence from firearm owners that ammo would remain readily available for the next 4 years

Despite that, certain calibers like 9mm have seen sustained price increases heading into December

The firearms industry witnessed significant market turbulence in November 2024, with ammunition prices experiencing dramatic swings driven by a perfect storm of political change and manufacturer announcements. As the dust settles from the presidential election and major industry players signal upcoming price adjustments, both retailers and consumers find themselves navigating an increasingly complex marketplace. This comprehensive analysis dives into the recent price fluctuations, emerging trends, and factors shaping the future of ammunition availability and cost.

Ammo Prices Surge Before Election, Drop Following Trump Victory

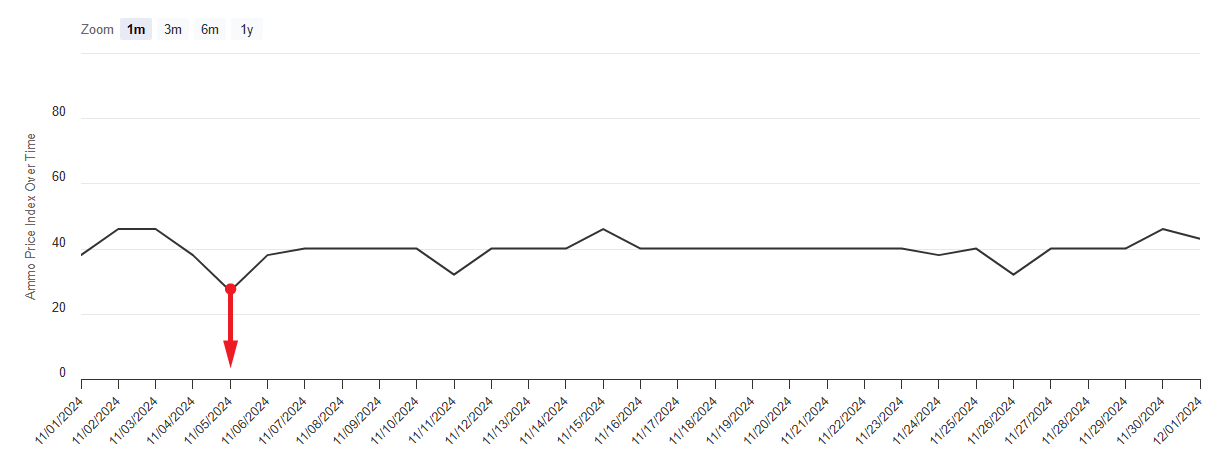

The ammunition market saw notable volatility in the weeks surrounding the 2024 U.S. presidential election, as reflected in the recent Southern Defense Ammo Price Index. Prices surged in the days leading up to the November 5 election, driven by widespread uncertainty and preemptive buying by consumers concerned about potential regulatory changes. However, the trend sharply reversed following Donald Trump’s victory, with prices stabilizing and ultimately declining in the days after the election.

Ammo Price Index - November 2024

Source: Southern Defense

Historically, election years tend to fuel fluctuations in ammunition demand, particularly when the prospect of stricter gun control policies looms. In this instance, many consumers likely purchased ammunition in bulk ahead of November 5, fearing tighter regulations should a Democratic candidate win. This surge in demand caused a noticeable price spike in the final days of October and the start of November.

Trump’s victory, however, brought immediate reassurance to gun owners and the firearms industry. Known for his strong pro-Second Amendment stance and promises to maintain a deregulated environment for gun ownership, his election quelled concerns about imminent policy shifts. As a result, demand leveled off, and prices dropped, reflecting a more stable market outlook.

By late November, ammunition prices appeared to have plateaued at a lower level compared to their pre-election peak, indicating that the market had adjusted to the post-election environment. Analysts suggest that Trump’s policies, focused on deregulation and supporting gun ownership, are unlikely to disrupt the ammunition supply chain or trigger further price volatility in the short term.

The trends observed during this election cycle underscore the deep connection between political developments and consumer behavior in the firearms market, with policy uncertainty playing a pivotal role in shaping demand and pricing dynamics.

Ammunition Market Shows Mixed Trends on Caliber Level as Year Ends

The ammunition market has been experiencing significant price volatility when looked on the caliber level, with notable divergences across different calibers. Current market data shows dramatic shifts, with some ammunition types seeing steep declines while others post considerable gains.

Leading the price decreases with handguns is is 480 Ruger ammunition, showing a substantial 24.59% drop, while on rifles there was a significant drop with 8mm Mauser ammo, dropping a whopping 33.66%. Other hunting calibers like 20 Gauge (-14.17%) and 10mm Magnum (-12.40%) have also seen double-digit percentage decreases. The reduced demand, and post-election blues are likely the main drivers behind these double-digit price decreases for the set calibers.

Popular defensive rounds like .357 Rem Max and .40 Super showed more moderate declines of -7.32% and -8.43% respectively following the Election.

In contrast, some common calibers are experiencing notable price increases.

9mm ammunition, one of the most popular calibers for both civilian and law enforcement use, has risen by 25.29%. Similarly, 32 S&W has seen a 24.22% increase, while 38 Super prices have climbed by 20.83%.

Leading the ammo price increases on the rifle side this past month are 30-06 Springfield with 7.55% increase and 6.5 Grendel with 7.17% increase.

| Caliber | Price/Round | 1-mo Trend |

|---|---|---|

| 8mm Mauser | $0.60 | -33.66% |

| 480 Ruger | $1.59 | -24.59% |

| 20 Gauge | $0.23 | -14.17% |

| 10mm Magnum | $0.54 | -12.40% |

|

6.8mm Remington |

$0.68 | -10.96% |

| 21 Sharp | $0.19 | -10.34% |

| 45 Win Mag | $0.96 | -8.56% |

| Caliber | Price/Round | 1-mo Trend |

|---|---|---|

| 9mm | $0.15 | +25.29% |

| 32 S&W | $0.84 | +24.22% |

| 38 Super | $0.44 | +20.83% |

|

22 TCM |

$0.35 | +14.74% |

| 40 S&W | $0.26 | +9.48 |

| 30-06 Springfield | $0.74 | +7.55% |

| 6.5 Grendel | $0.75 | +7.17% |

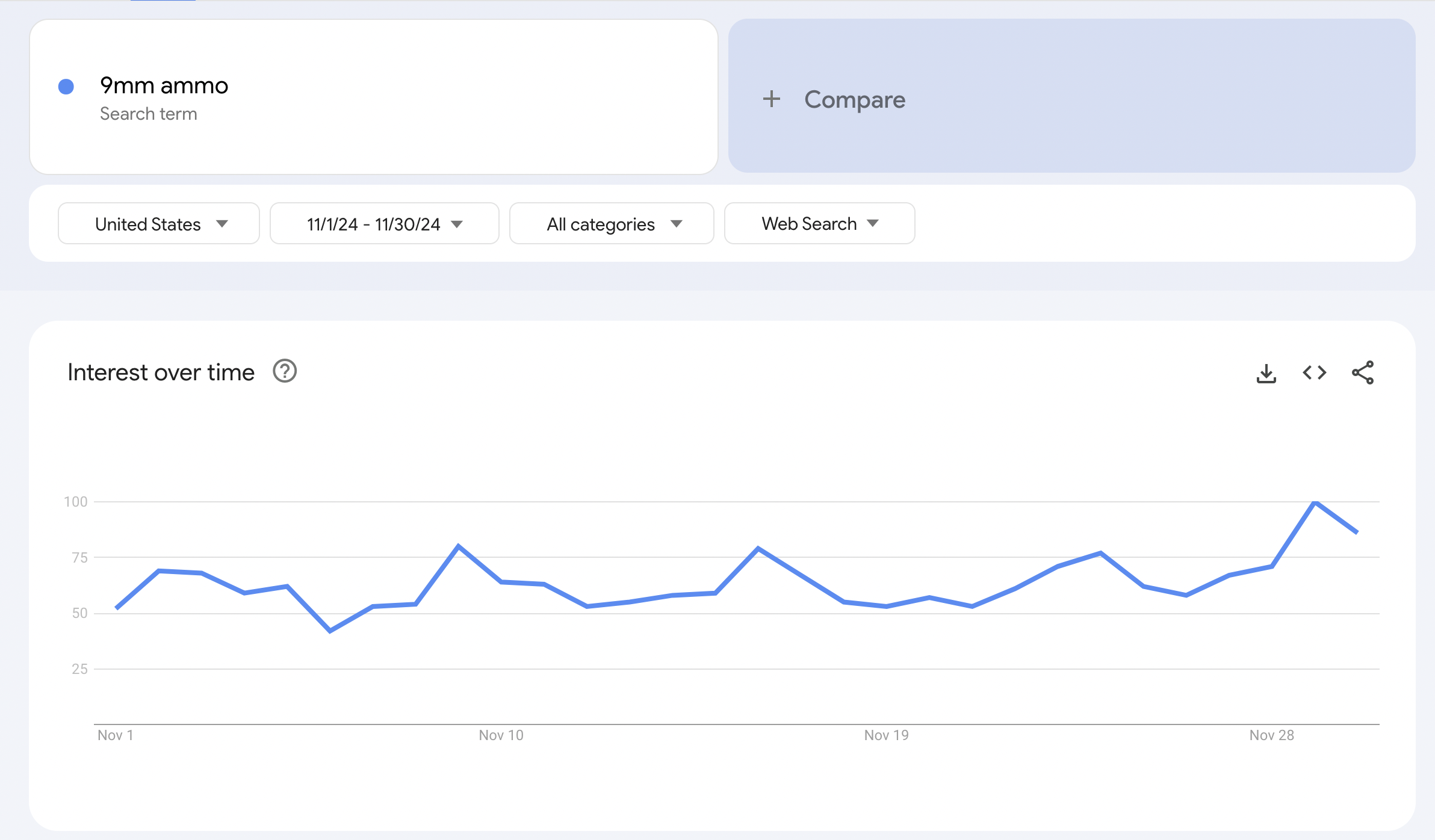

It is quite interesting, especially if we look at the demand for 9mm ammo via Google Trends where interest rose from 42 to 80, likely driven by a surge of buying interest right after the election and in awe of the previously announced prices increase by Winchester ammo

9mm Ammo Search Volumes in November 2025.

Source:

Google Trends

Market analysts are closely watching these price movements, particularly in light of October reports by Winchester Ammunition and their scheduled price increase in January 2025, especially as general opinion is that in 2025 other manufacturers will follow with similar increases. These market dynamics reflect a complex interplay of factors including supply chain conditions, manufacturing costs, and consumer demand patterns that all affect the market longer term, as opposed to the short term changes that elections have brought this past month.

Looking Ahead Into 2025

The ammunition market's response to the 2024 election has been swift and significant, with prices stabilizing after initial volatility. However, Winchester's announced price increases for January 2025 and potential similar moves by other manufacturers signal important changes ahead. While some calibers like 480 Ruger and 20 Gauge have seen notable price drops, popular rounds like 9mm continue to surge, reflecting complex market dynamics that extend beyond political factors.

At Southern Defense, we remain committed to monitoring these market shifts and providing our customers with the most competitive ammunition prices possible. Our regularly updated Ammo Price Index and market analysis tools are designed to keep you informed and help you make smart purchasing decisions. As the market continues to evolve, you can count on us to provide transparent, timely information about price trends and industry changes, ensuring you stay ahead of market movements and get the best value for your ammunition purchases.