House Sends Bill Eliminating $200 NFA Tax on Suppressors and Short-Barreled Rifles to Trump’s Desk: A Major Win for Gun Owners

Author: Aleksa M. | Publish Date: Jul 03, 2025 | Fact checked by: Marko Lalovic

Congress has just passed a landmark piece of legislation that eliminates the $200 transfer and making tax on suppressors and short-barreled rifles (SBRs), sending the bill to President Trump’s desk for signature. This development is being celebrated as a significant victory for gun owners and Second Amendment advocates across the nation. While the bill does not go as far as some had hoped—full deregulation of suppressors was excluded following a Senate parliamentarian’s ruling—the elimination of the tax burden marks the most substantial reform to National Firearms Act (NFA) items in decades. This article will break down what made it into the final bill, what was left out, the legislative process that got us here, and the controversy surrounding Silencer Central’s lobbying efforts.

Key Findings Summary

Section 70436 of the “One Big Beautiful Bill Act” amends the Internal Revenue Code to set the transfer and making tax for suppressors and SBRs at $0, while retaining the $200 tax for machine guns and destructive devices. The bill originally sought to remove suppressors from NFA regulation entirely, but this provision was struck due to a ruling by the Senate parliamentarian. The legislative process was marked by intense debate, amendments, and a last-minute scramble in the Senate, ultimately resulting in a compromise that gun rights groups have hailed as a major, if partial, win. The bill’s journey through Congress reflects the shifting political landscape around gun rights and regulatory reform, and its passage is expected to have far-reaching effects on firearm ownership, industry practices, and the broader debate over the Second Amendment.

The Bill’s NFA Provisions: What Made It In

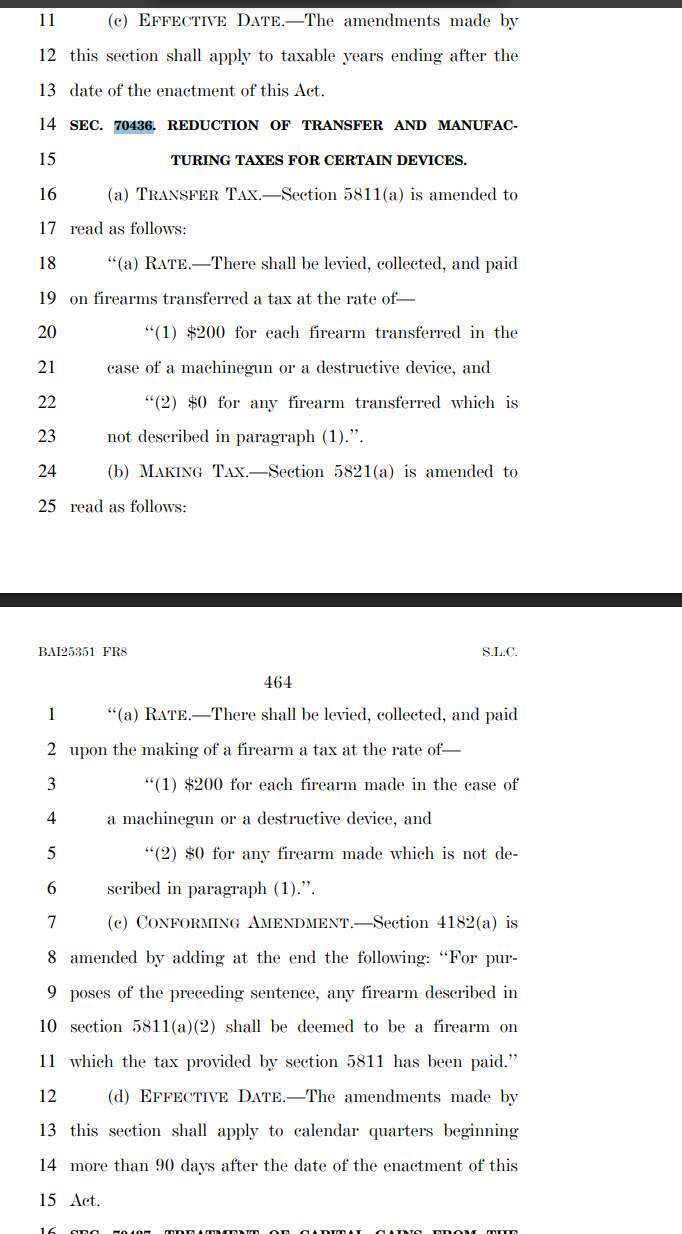

The pivotal reform for gun owners is found in Section 70436, titled “Reduction of Transfer and Manufacturing Taxes for Certain Devices.” This section directly amends the Internal Revenue Code, specifically Sections 5811(a) and 5821(a), to set the transfer and making tax for suppressors and short-barreled rifles at $0, while leaving the $200 tax for machine guns and destructive devices untouched.

The bill language is explicit:

(1) $200 for each firearm transferred in the case of a machinegun or a destructive device, and

(2) $0 for any firearm transferred which is not described in paragraph (1).

(1) $200 for each firearm made in the case of a machinegun or a destructive device, and

(2) $0 for any firearm made which is not described in paragraph (1).

The effective date for these amendments is set for taxable years and calendar quarters beginning after the date of enactment, with a short implementation window of no more than 90 days for administrative adjustments.

Impact for Gun Owners

For decades, law-abiding citizens seeking to acquire a suppressor or SBR faced a $200 tax per item—a fee that, when adjusted for inflation, represented a substantial barrier to entry. With the passage of this bill, that tax is eliminated, making suppressors and SBRs vastly more accessible to ordinary Americans. The transfer process remains in place, but the financial burden is lifted, which is expected to drive a surge in applications and ownership.

What Was Excluded: The Suppressor Deregulation Fight

While the elimination of the $200 tax is a landmark achievement, the bill’s journey through Congress was marked by disappointment for those who hoped for the full deregulation of suppressors. Early drafts of the legislation included language that would have removed suppressors from the NFA entirely, reclassifying them as ordinary firearms and eliminating the need for federal registration, background checks, and the lengthy approval process that currently accompanies suppressor purchases.

The Senate Parliamentarian’s Ruling

The full deregulation provision was ultimately struck from the bill following a ruling by the Senate parliamentarian, who determined that such a change was not germane to the budget reconciliation process under which the bill was being advanced. This procedural hurdle proved insurmountable, forcing lawmakers to strip the provision in order to preserve the overall integrity of the legislative package and ensure its passage through the Senate’s narrow majority.

Reaction from Gun Rights Advocates

Gun rights organizations expressed mixed feelings about the exclusion. The American Suppressor Association (ASA) and other advocacy groups praised the elimination of the tax as a major step forward but lamented the missed opportunity for full deregulation. The ASA stated that while they were disappointed suppressor deregulation was removed due to procedural rules, the elimination of the $200 tax is a watershed moment for the Second Amendment community, and they will continue to fight for full deregulation in future legislative sessions.

Timeline: The Bill’s Journey Through Congress

The legislative journey of the “One Big Beautiful Bill Act” was marked by a series of dramatic developments, reflecting both the complexity of the bill and the contentious nature of gun policy in the United States. Here is a timeline of key events, drawing on the bill text and contemporaneous news coverage.

Early 2025: Bill Introduction and Committee Hearings

The bill was introduced in the House in early 2025 as part of a broader legislative package aimed at delivering on a range of presidential priorities, including tax relief, regulatory reform, and Second Amendment protections. The NFA tax repeal provisions were included in the initial draft, alongside language to fully deregulate suppressors.

House committee hearings featured testimony from gun rights advocates, industry representatives, and public safety officials. Supporters argued that the NFA tax was an outdated relic that disproportionately burdened law-abiding citizens, while opponents warned of potential risks to public safety.

Spring 2025: House Passage

After several rounds of amendment and debate, the House passed the bill with the NFA tax repeal and suppressor deregulation provisions intact. The vote was largely along party lines, with a handful of moderate Democrats joining Republicans in support.

Early Summer 2025: Senate Scrutiny and Amendments

Upon arrival in the Senate, the bill faced intense scrutiny from both sides of the aisle. Senate leadership sought to advance the bill using the budget reconciliation process, which allows for expedited consideration but imposes strict limits on the types of provisions that can be included.

It was during this stage that the Senate parliamentarian issued a ruling striking the suppressor deregulation language as non-germane to reconciliation. Senate leaders, eager to preserve the broader legislative package, reluctantly agreed to remove the provision, leaving only the tax repeal in place.

Late June 2025: Final Passage and Conference Committee

With the suppressor deregulation provision removed, the Senate passed the amended bill. A brief conference committee reconciled minor differences between the House and Senate versions, and the final bill was quickly approved by both chambers.

July 2025: Bill Sent to President Trump

On July 3, 2025, the bill was formally sent to President Trump’s desk for signature. The White House has signaled strong support for the legislation, and a signing ceremony is expected in the coming days.

Comparative Table: NFA Taxation Before and After the Bill

| NFA Item | Previous Tax (per item) | New Tax (per item) | Regulatory Status |

|---|---|---|---|

| Suppressors | $200 | $0 | Still NFA-regulated |

| Short-Barreled Rifles | $200 | $0 | Still NFA-regulated |

| Machine Guns | $200 | $200 | Still NFA-regulated |

| Destructive Devices | $200 | $200 | Still NFA-regulated |

Table: Changes to NFA Transfer and Making Taxes under Section 70436 of the "One Big Beautiful Bill Act"

The Silencer Central Scandal: Industry Lobbying and Community Outrage

No discussion of this bill’s passage would be complete without addressing the controversy that erupted in the suppressor industry—specifically, the scandal involving Silencer Central, one of the nation’s largest suppressor retailers.

We have written about this extensively previously which you can read in our previous article:

Silencer Central and the NFA: Allegations, Lobbying Disclosures, and Community Reaction

Conclusion

The elimination of the $200 NFA tax on suppressors and short-barreled rifles represents a historic victory for gun owners and the broader Second Amendment community. While the bill falls short of full deregulation, it removes a major financial barrier and sets the stage for future reforms. The legislative process that produced this outcome was marked by intense debate, procedural challenges, and ultimately, a pragmatic compromise that delivered meaningful change without sacrificing the broader legislative agenda.

The controversy surrounding Silencer Central serves as a cautionary tale about the potential for industry interests to diverge from those of grassroots advocates. As the bill heads to President Trump’s desk, gun owners across the country are celebrating a hard-won victory—and looking ahead to the next battle. At BlackBasin.com, we will continue to provide comprehensive coverage, analysis, and advocacy as the story unfolds.

Author:

Aleksa Miladinovic

Aleksa Miladinovic is a passionate technology enthusiast born and raised in Serbia, whose interest in defense technology was sparked by his country's rich firearms manufacturing heritage. His journey began when attending a Partner defense exhibition in Belgrade, where he was captivated by the innovative engineering and precision mechanics behind modern defense systems. With Serbia being a significant producer of military equipment in the region, Aleksa has developed a deep appreciation for the technical advancements and engineering excellence that the firearms industry represents.